|

|

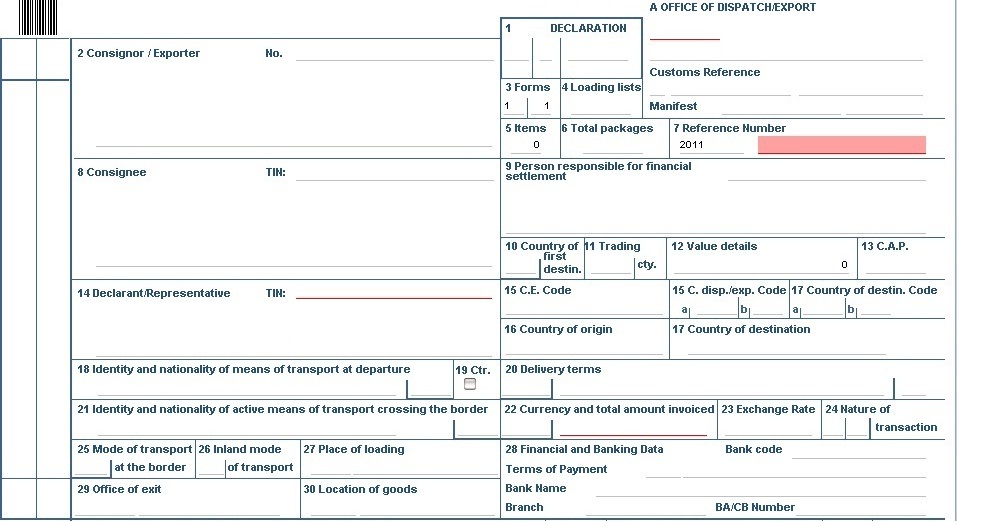

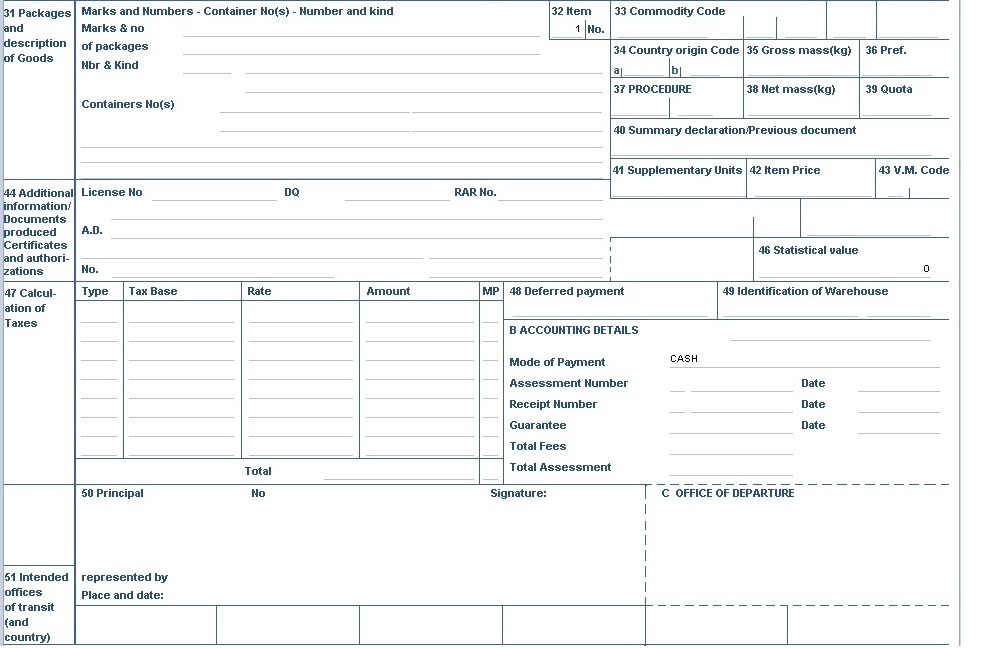

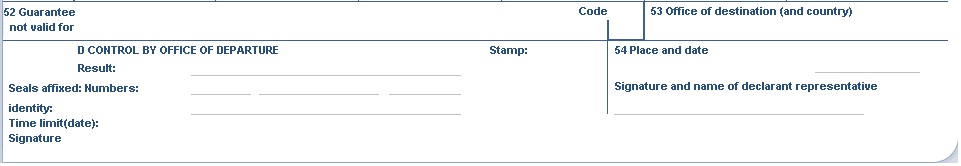

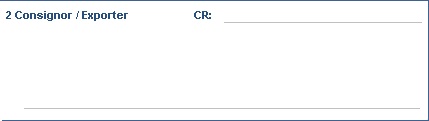

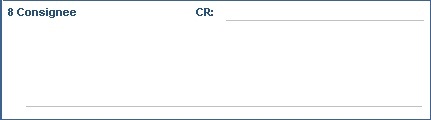

1.2 SAD Template

The General Segment containing information describing the whole consignment, valuation note, total values and total taxes assessed; the general segment consists of fields that describe the general aspects of the declaration, information elements that are applicable to the whole set of imported/exported items.

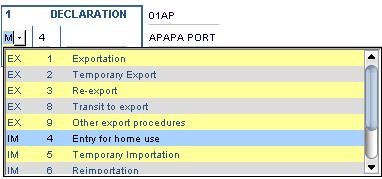

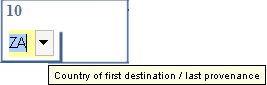

The valuation note at item level is only used to enter the FOB value; the values for total costs (freight, insurance, etc.) are calculated as (1) Consignor: Enter Tax Identification Number (TIN) of the Consignor/Exporter at Export or the full name and address at Import. (2) Consignee: At Import, enter the Unique Tax Identification Number of the company; name and address will automatically be displayed. (3) Manifest: Enter the unique manifest reference number (voyage number) for this consignment. (4) Model of Declaration: From the drop-down list, select the relevant Customs Regime code or Community code. (5) Number of Forms: The subset number out of the total number of forms will be displayed automatically in box 3 (example : 1/3, 2/3 and so on) (6) Loading Lists: The number of any loading lists (delivery notes) attached, or number of commercial descriptive lists authorized by the competent authority. (7) Number of Items: The total of items described on the SAD is automatically displayed in this box. (8) Reference Number: This is a Unique Identification Number used to track and trace the SAD. The year is automatically set. (9) Total Packages: The total number of packages contained in the consignment is automatically displayed in this box as the sum of packages of all items. (10) Beneficiary: Enter the Tax Identification number for the person responsible to effect the actual payment of duties and taxes for this consignment. (11) Country of first destination/last provenance For Export, input the country of first destination.

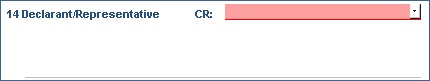

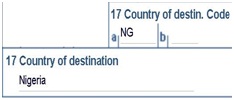

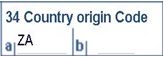

For Import, input the country of last provenance. (12)Trading Country: Enter the code of the trading country. This is the country of the exporter. (13) C.A.P – Common Agricultural Policy Reference; this is valid for EU countries only.: The total number of packages contained in the consignment is automatically displayed in this box as the sum of packages of all items. (14) Declarant/Representative: Enter the Unique Tax Identification Number assigned to the authorized Customs House Broker licensed under the Customs Act to process Customs Declaration Forms and complete customs formalities. (15) Country of origin: This is the country where goods were manufactured. (16) Country of destination code: At import, the reference country automatically pops up.At export enter the last country of destination (final destination)

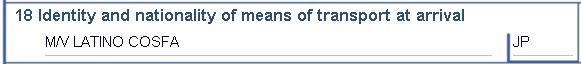

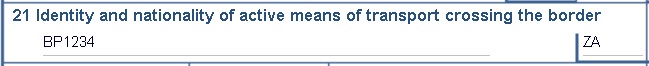

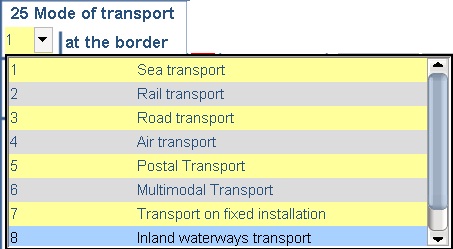

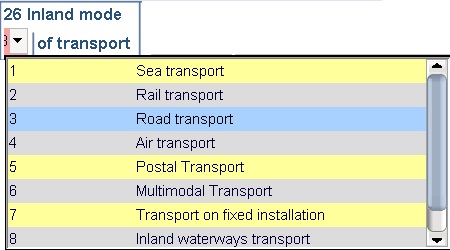

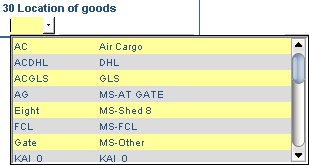

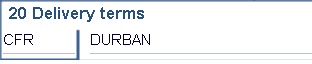

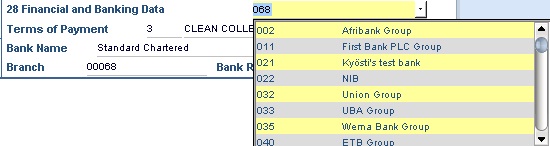

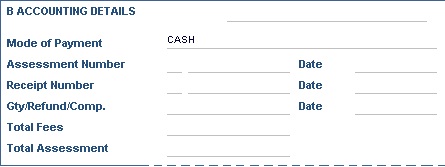

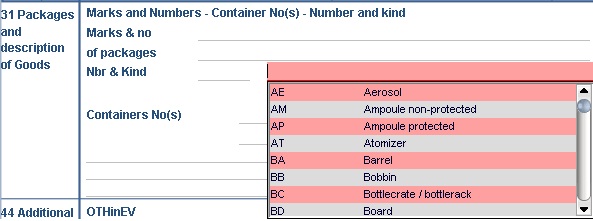

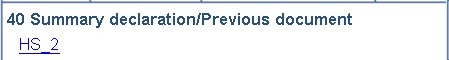

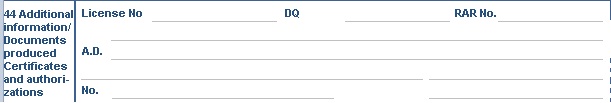

(17) Identity and nationality of transport at arrival: Enter the M/V Vessel identification number (by sea) OR Aircraft identification number (by air) OR Vehicle registration number (by road) OR Wagon number (by railway) on which the goods are directly loaded at the time of export or transit formalities, followed by the nationality of the means of transport. (18)Identity and nationality of active means of transport crossing the border: Enter the M/V Vessel identification number (by sea) OR Aircraft identification number (by air) OR Vehicle registration number (by road) OR Wagon number (by railway) on which the goods are directly loaded at the time of crossing the border or transit formalities, followed by the active nationality of the means of transport. (19) Mode of transport at the border: Import: Enter the mode of transport corresponding to the active means of transport active with which the goods entered the customs territory of the Community. (20) : Inland mode of transport: Import: Mode of transportupon arrival from border. (21) Location of goods: Enter the precise location where the goods will be stored waiting for clearance and exit. (22) Delivery terms: Enter the delivery terms as per Incoterms (CIF, FOB, CIFC, C&F, Ex-Work, Ex-factory) and the name of the place where the transaction was exercised. (23) Currency and total amount invoiced: Enter in the first sub-division, the currency in which the commercial invoice was transacted. In the second sub-division, enter the invoiced value for all items declared. (24) Rate of Exchange: The box will automatically display the exchange rate of the transaction. (25) Nature of transaction: Enter the nature of transaction concerned (26) Financial and banking data: Enter the Bank code(Financial and Banking Data). (27) Accounting: (28)Identification of warehouse : This box has 2 subdivisions: Warehouse code and Delay (validity period of goods staying in warehouse, e.g. 365 days). (29)Packages and descriptionsof goods : This box has 2 subdivisions: Warehouse code and Delay (validity period of goods staying in warehouse, e.g. 365 days). (30)Gross Mass(kg): Enter the gross weight in kilograms (kg) of goods described in this box (31)Net Mass (kg) : The net mass is the mass of the goods without any packaging. (32)Supplementary Units: Enter the quantity of the item, expressed in the unit laid down in the goods nomenclature (HS code). (33)Commodity code: Enter the correct classification number or commodity code based on the Harmonized System of coding. (34)Place of Loading: Enter the place within the country of reference, as known at the time of completion of formalities, at which the goods are to be loaded onto the active means of transport on which they are to cross the Community frontier. (35)Country of origin code: Enter the 2-alpha code of the country of origin where the goods were manufactured or produced. (36) Procedure: Enter the adequate procedure code. (37) Item Price: This box automatically takes the FOB value in Foreign currency entered inthe Item Valuation Note for the specific item.This field is actually labeled as "Item Price" in EU SAD. (38) V.M code: By default, V.M [Valuation Method] takes value 1 as Transaction value. However, user can change the V. M code based on the appropriate valuation method used. (39) Statistical Value: The TWM system will automatically take the statistical value expressed in national currency from the Item Valuation Note form. (40) Adjustment: This box is reserved and by default the value is 1. To double the statistical value, enter 2. (41)Quota: This is an EU code. Enter the order number of the tariff quota for which the declarant/broker/clearing agent is applying.This is a free field. (42)Summary declaration/Previous declaration: Enter the reference of the Bill Of lading (BOL). (43)Additional information/Documents produced/Certificates and authorizations: (44)Calculation of taxes: TWM comprises a powerful tax engine which automatically triggers the computation of all types of customs duties and taxes, namely, customs duties, excise duties, anti-dumping duty, counter-veiling duty and fees, etc. Taxes are configured through tax scripts from within the TWM configuration module. TWM toolbar will efficiently assist with the completion of the

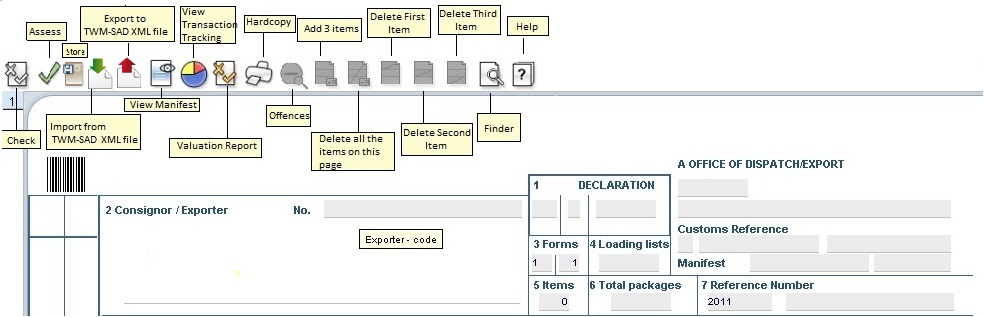

customs declaration; the following icons will be available if user rights are

adequate. Icon Functions Check for validity and correctness Store a SAD Assess a SAD Upload a template of SAD through an XML file Locally save a SAD by exporting the corresponding XML file

to a media View Manifest View Transaction Tracking Valuation Report Print a hard copy of the SAD, default WYSIWYG printout,

other printer icons can be added in order to print customized layouts Offences Add 3 additional items (additional page) Delete the three (3) items on this page Delete the 1st item on this page Delete the 2nd item on this page Delete the 3rd item on this page Finder Help

|

|

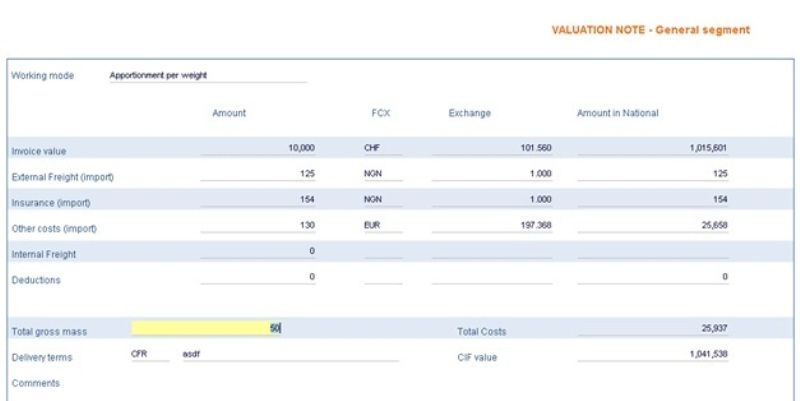

1.4 VALUATION NOTE - General Segment

The valuation note form contains monetary values associated with the declaration, which are the base values for the calculation of taxes.

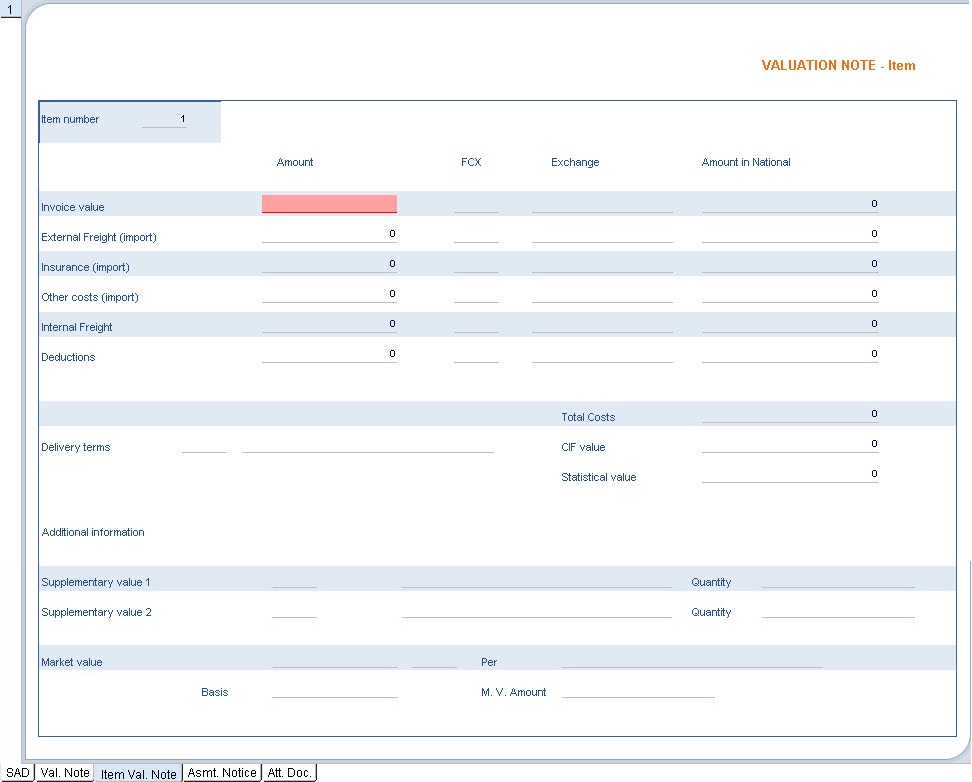

1.5 VALUATION NOTE - Items

The valuation note at item level is only used to enter the FOB value; the values for total costs (freight, insurance, etc.) are calculated as

Total Costs: Automatically calculated by the system; it displays Insurance + External freight + Other costs + Internal freight - Deductions. The form displays the detailed calculation of duties and taxes payable by the importer. Each applicable tax (e.g. Import Duty or Surcharge) will be shown with its corresponding amount. This feature provides transparency to the process, since the importer knows exactly how much Important Data Elements in Valuation Note - Item

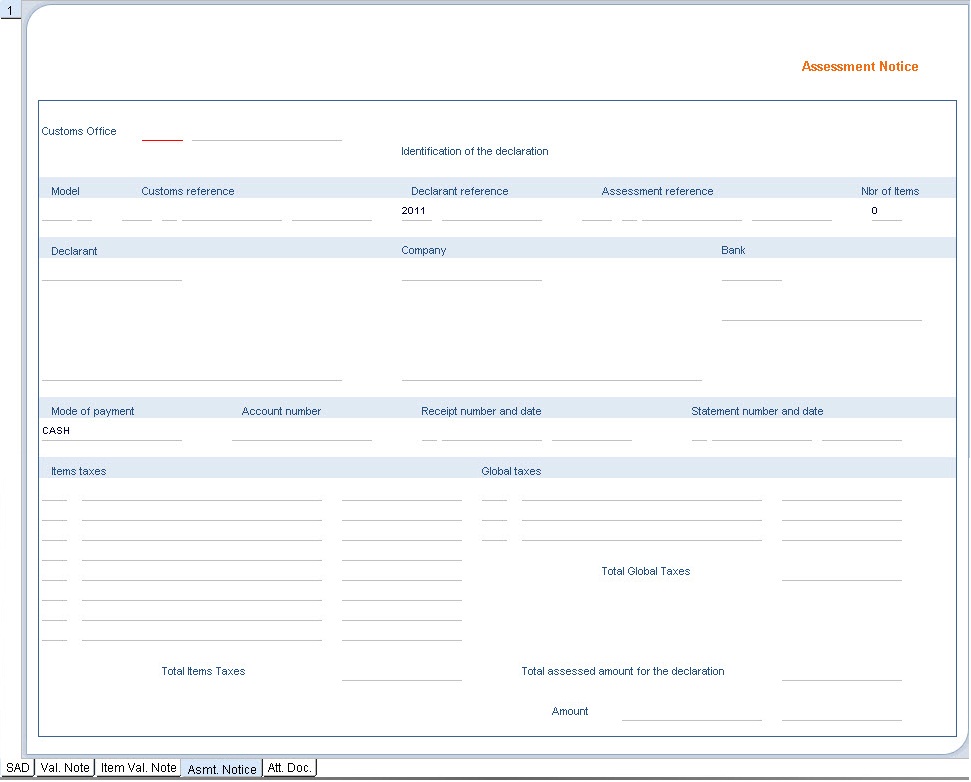

Item Taxes: This is sum of the dutiable amount for all item taxes of the declaration, per tax. - Total Item Taxes: Sum of all amounts for all item taxes.

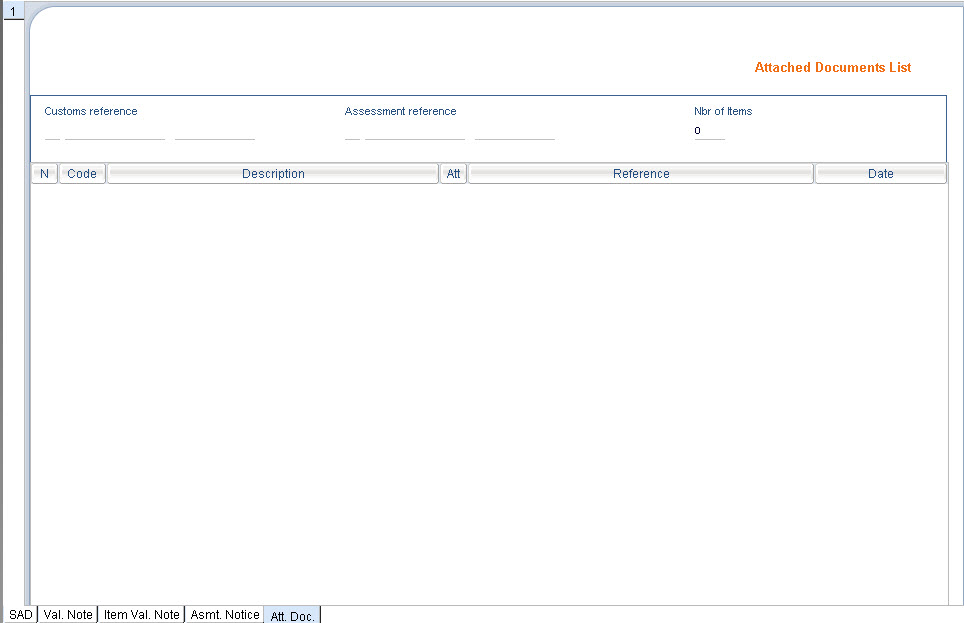

- Total Global Taxes: Sum of all General Segment taxes (e.g. processing fee) - Total Assessed Amount: Total Item taxes plus Total Global taxes Accessible by clicking on the form tab Att. Doc. This form provides facilities to enter the details of the mandatory documents

that needs to be attached to the SAD (document code, description, reference and date of issue). The declarant can upload a scanned picture of the document:

scanned(digital)copies of commercial documents such as invoice, packing list, transport document, phytosanitary certificate, import permit and other related e-documents can be attached to the declaration.

Customs officers during the declaration verification and the post-clearance audit may display these documents on the screen,

thus avoiding the need to refer to the physical documents.

.

part of the apportionment program

set at Valuation Note General Segment level, within the same declaration.

Important Data Elements in Valuation Note - Item

to the border are calculated automatically

as a proportion of the global Insurance costs, unless No apportionment, computed totals option is selected.

1.6 Assessment Notice

he must give his broker to clear his consignmentfrom Customs, and enable him to prepare better costing.

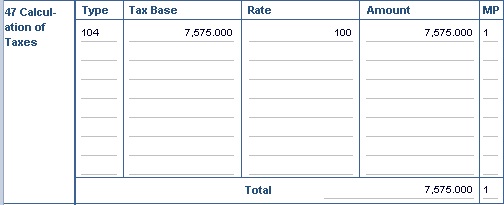

1.7 Attached Documents List